Easy Sources Of Passive Income

Easy Sources Of Passive Income

What Are The Pros Of Passive Income?

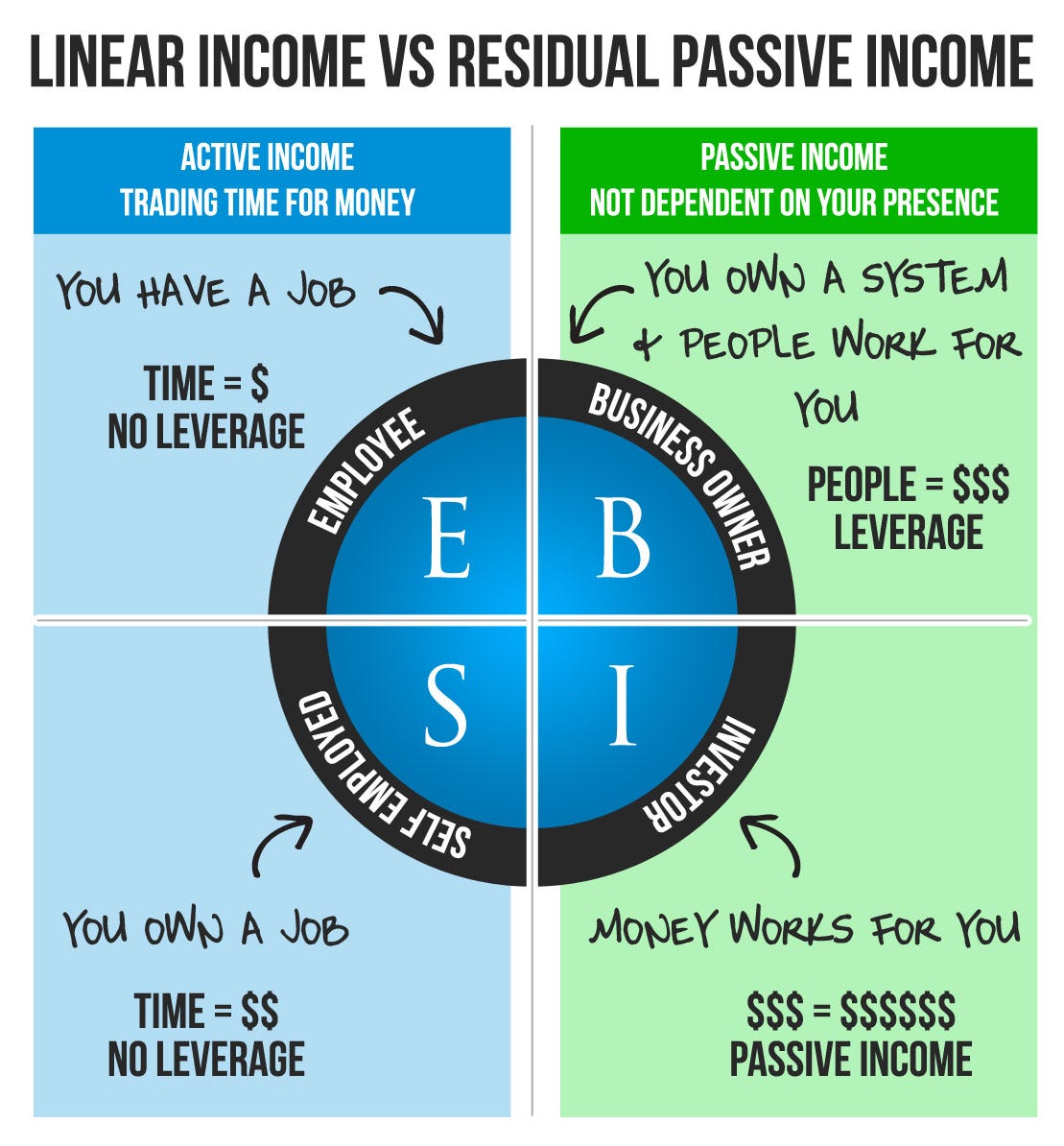

Passive income is a type of income that requires little to no effort from you to maintain. It’s a great way to make money without having to actively work for it. It’s also a great way to diversify your income sources and reduce your reliance on one income stream. Passive income can come in many forms, such as dividend payments, rental income, royalties, and even interest payments. It can be a great way to build wealth and achieve financial freedom.

The biggest pro of passive income is that it can provide a steady stream of income without you having to actively work for it. This means that you can make money while you sleep, which can be incredibly rewarding and freeing. Passive income can also be incredibly lucrative if you know how to use it properly. You can use it to supplement your existing income or even to replace it entirely.

Passive income is also great for those who want to increase their financial freedom. With passive income, you can work less and still make money. This means that you can enjoy a more flexible lifestyle and have more freedom to do what you want. You can also use passive income to save for retirement or to buy a bigger house.

What Are The Cons Of Passive Income?

The biggest con of passive income is that it can take a long time to generate. With most passive income sources, you need to invest a large sum of money upfront and wait for it to pay off. It can be difficult to predict how long it will take for your investments to pay off, and some investments may never pay off.

Another con of passive income is that it can be hard to manage. You need to keep track of all your investments and make sure that you’re reinvesting or diversifying your income sources. You also need to keep an eye on the markets and make sure that your investments are performing well. If you don’t stay on top of your investments, you may end up losing money.

Finally, passive income can be risky. While it can be incredibly lucrative, there’s always the risk of losing money. You need to make sure that you’re making smart investments and that you’re diversifying your income sources in order to minimize the risk.

What Are Some Common Sources Of Passive Income?

One of the most common sources of passive income is real estate investing. You can buy a property, rent it out, and collect rental income. You can also invest in real estate crowdfunding or REITs, which are companies that own and manage real estate assets. Another common source of passive income is investing in stocks and bonds. You can also invest in dividend-paying stocks or mutual funds.

Peer-to-peer lending is another popular source of passive income. With peer-to-peer lending, you can lend money to other people and earn interest on the loans. You can also invest in stocks, bonds, and mutual funds through robo-advisors, which are automated investment platforms. Finally, you can invest in index funds, which track a stock market index and provide a steady stream of income.

Conclusion

Passive income can be a great way to make money without actively working for it. It can provide a steady stream of income and help you achieve financial freedom. However, it can take a long time to generate and can be hard to manage. It’s important to do your research and make smart investments in order to maximize your returns. With the right investments, passive income can be a great way to increase your wealth and achieve financial freedom.