Extra Earned Income Tax Credit

How to Take Advantage of the Extra Earned Income Tax Credit

If you're looking for ways to save money on your taxes, you may be surprised to learn that you can take advantage of the Extra Earned Income Tax Credit (EITC). The EITC is a tax credit that is available to eligible taxpayers who meet certain income and filing requirements. It can provide a significant reduction in your taxes, so it is important to understand how the EITC works and how you can qualify.

Who Qualifies for the Extra Earned Income Tax Credit?

In order to qualify for the EITC, you must meet certain income requirements. Generally, your adjusted gross income must be below $50,000 if you are single and $55,000 if you are married and filing jointly. You must also meet certain other requirements such as filing a tax return, being employed, and having a valid Social Security number. Additionally, you must have earned income from either wages, self-employment, or a combination of the two.

How Much Is the Credit Worth?

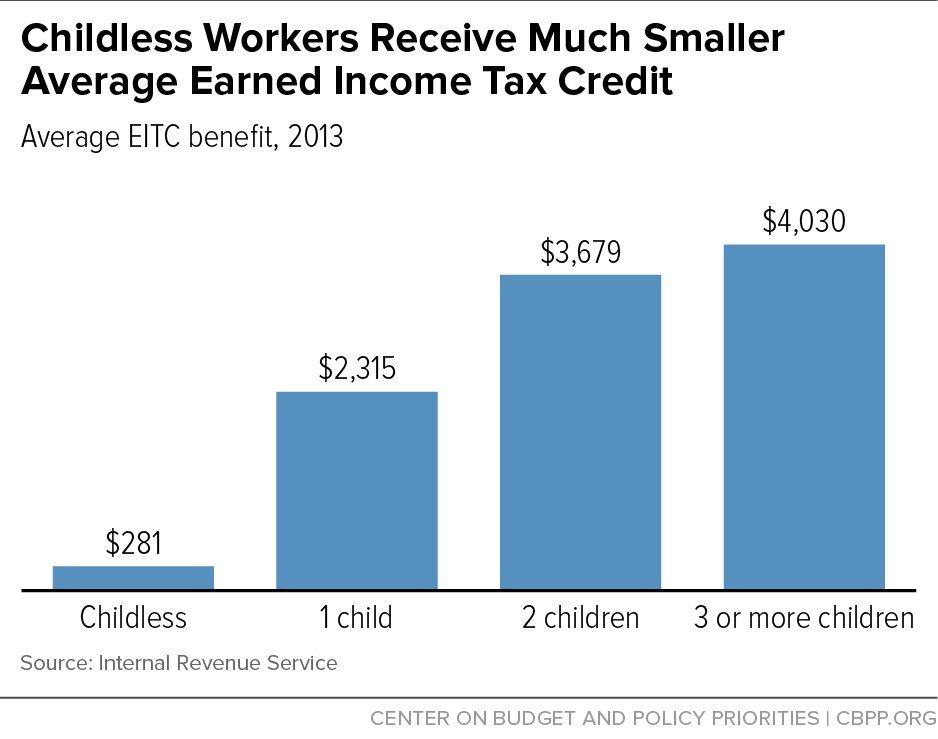

The amount of the credit you can receive will depend on your income, filing status, and the number of children you have. For a single filer with no children, the maximum amount is $520. For a married couple filing jointly with three qualifying children, the maximum amount is $6,557. The credit can be very beneficial, so it is worth researching the requirements and consulting a qualified tax professional to find out if you qualify.

How to Claim the Credit

If you are eligible for the EITC, you will need to claim it on your tax return. To do this, you will need to fill out IRS Form 1040 or 1040A and include Schedule EIC, which is the Earned Income Credit form. You will need to provide information about your income, filing status, and the number of children you have. Once you have completed the form, you will need to submit it with your tax return.

Advantages of the Credit

The EITC can provide a significant reduction in your taxes, which can put more money in your pocket. Additionally, the credit can be used to offset any federal income taxes you owe. This can be especially helpful if you are expecting a large refund or if you are facing a large tax bill. Furthermore, the credit can also be used to offset any Social Security taxes you may owe.

Tips for Claiming the Credit

When claiming the EITC, it is important to make sure that you are providing accurate information. If the IRS determines that you have provided inaccurate information, you may be subject to penalties and interest charges. Additionally, it is important to keep accurate records of your income and filing status throughout the year. This will help you ensure that you are taking full advantage of the credit when filing your taxes.

The Extra Earned Income Tax Credit Can Provide Significant Tax Savings

The EITC is a great way to reduce your taxes and save money. It is important to understand the requirements and to keep track of your income and filing status throughout the year. By taking advantage of the EITC, you can put more money in your pocket and reduce the amount of taxes you owe. In the end, it can be a great way to save money on your taxes.